How to Use & Reduce Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC)

How to Use & Reduce Customer Acquisition Cost (CAC): A Comprehensive Guide

Customer Acquisition Cost (CAC) is a key performance indicator (KPI) for any business focused on growth, profitability, and long-term sustainability.

It measures the cost of acquiring a new customer, providing critical insights into the efficiency of your marketing and sales strategies.

By understanding and optimizing CAC, businesses can allocate resources more effectively, improve profitability, and enhance overall growth.

This comprehensive guide will break down everything you need to know about CAC, how to calculate it, and strategies to reduce it.

Whether you’re a startup or an established business, understanding and managing CAC is essential for scaling your operations successfully and sustainably.

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) refers to the total amount of money a business spends to acquire a new customer.

This includes all marketing, sales, and other related costs that contribute to the acquisition process. The concept of CAC is especially vital for businesses looking to scale because it directly affects profitability and growth.

If the cost of acquiring new customers is too high, it can severely limit your ability to grow sustainably.

How is CAC Calculated?

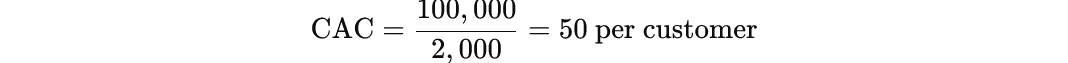

CAC is calculated by dividing the total costs spent on acquiring customers by the number of customers acquired in the same period. The formula is simple:

For example, let’s say your business spent $100,000 on marketing and sales efforts in a quarter, and you acquired 2,000 new customers. Your CAC would be:

Components of CAC

CAC is not a single expense but rather the total cost associated with attracting and converting a customer. The components of CAC typically include:

1. Marketing Costs

- Advertising: The cost of paid advertisements (e.g., Google Ads, Facebook Ads) and organic advertising (e.g., influencer collaborations, media placements).

- Content Marketing: Costs associated with creating and distributing valuable content such as blogs, videos, webinars, and infographics.

- Email Marketing: Expenses related to email campaigns, including platform costs (e.g., Mailchimp, HubSpot) and the cost of content creation.

- SEO: Investments in search engine optimization (SEO) efforts, including paid tools, external agencies, and internal resources.

- Public Relations (PR): The costs of managing public relations, such as media outreach, press releases, and community engagement activities.

2. Sales Costs

- Sales Salaries and Commissions: Direct compensation costs, including salaries, commissions, and performance bonuses for the sales team.

- Sales Tools: Expenses for sales-related software like Customer Relationship Management (CRM) systems, analytics platforms, and other tools designed to facilitate lead generation and sales conversion.

- Travel and Entertainment: If applicable, the travel, lodging, meals, and entertainment expenses incurred during client meetings or sales trips.

3. Other Acquisition-Related Costs

- Recruitment and Onboarding: Hiring costs for acquiring new marketing and sales team members, as well as the time and expense spent training them.

- Customer Acquisition Software: The cost of software specifically aimed at improving customer acquisition efforts (e.g., lead scoring platforms, marketing automation tools).

Why CAC Matters

Understanding and optimizing CAC is essential for several key reasons. Here’s why this metric is so important for businesses of all sizes:

1. Profitability

One of the most direct ways CAC impacts profitability is by determining whether the business is spending more to acquire customers than it can expect to make from those customers in return.

If the CAC is too high compared to the customer lifetime value (CLTV), a business may be losing money on every new customer. This imbalance makes it difficult for companies to scale profitably.

For instance, if it costs you $200 to acquire a customer and that customer only generates $100 in revenue over their lifetime, you’re operating at a loss.

2. Investment and Resource Allocation

CAC provides a clear view of the effectiveness of your marketing and sales efforts. By calculating and understanding CAC, businesses can more effectively allocate resources, prioritize high-ROI marketing channels, and streamline the sales process.

For example, if certain channels like SEO or email marketing generate more cost-effective leads, businesses can shift more budget towards these areas.

3. Benchmarking Performance

By regularly tracking CAC, businesses can benchmark their performance and see if they are improving over time.

Comparing your CAC to industry averages or against past performance helps you identify areas of success or failure.

For example, if you find your CAC is higher than the industry average, it may signal that you need to reevaluate your acquisition strategies.

4. Customer Quality and Retention

Low CAC is often a good sign, but it can also indicate that you are attracting a high volume of lower-quality customers who may not stick around.

Conversely, a higher CAC might signal that your business is attracting more valuable customers, but if the cost is unsustainable, it could put pressure on profits.

Ideally, businesses should aim for a balanced approach—where CAC is low enough to be profitable, but high enough to acquire quality customers who will stick with the brand long term.

How to Use CAC Effectively

Tracking and managing CAC is more than just calculating a single number—it’s about using it strategically to guide decision-making and improve overall business performance.

1. Track and Monitor CAC Regularly

To use CAC effectively, it’s essential to measure it regularly and assess trends over time. This will help identify fluctuations and areas for improvement.

A sudden spike in CAC could be a warning signal, suggesting inefficiencies or a shift in market conditions. Conversely, a decrease in CAC might suggest that your marketing efforts are becoming more efficient.

- Segment by Channel: Break down CAC by marketing channel (e.g., paid search, content, social media) and sales rep or product line. This segmentation will help you pinpoint high-performing channels and areas that require optimization.

- Monitor Over Time: Track your CAC over different periods (e.g., quarterly or monthly) to spot any upward or downward trends. This helps in diagnosing issues early before they significantly impact profitability.

2. Set Realistic CAC Goals

Establishing realistic CAC targets is essential for sustainable growth. These targets should align with your overall business model, industry norms, and financial goals.

- Industry Benchmarking: Look at industry standards for CAC to set a realistic target. What works for one industry (e.g., SaaS) might not apply to another (e.g., retail).

- Customer Lifetime Value (CLTV): The goal is for the CLTV to be at least 3 times higher than your CAC. If your CAC is $200 and your CLTV is $600, you’re operating at a healthy profit margin. If your CLTV is too low, it might be necessary to adjust pricing or retention strategies.

- Business Growth Stage: Early-stage startups may have a higher CAC due to a lack of brand recognition or optimization. However, as you scale and refine your marketing strategies, your CAC should decrease over time.

3. Compare CAC to Customer Lifetime Value (CLTV)

The most useful way to assess whether your CAC is sustainable is to compare it to the CLTV of your customers.

If the CAC is consistently higher than the CLTV, you’ll have to address this imbalance before pursuing further growth.

- Ideal Ratio: The general rule of thumb is that CLTV should be at least three times higher than CAC (3:1). If your CAC is too high relative to CLTV, your business is essentially paying more to acquire customers than it can make back from them in the long run, which is unsustainable.

4. Identify High-Performing Channels

Understanding which marketing and sales channels are delivering the best results is key to reducing CAC.

You don’t need to be everywhere—focus on the channels that bring in the most customers at the lowest cost.

- Performance Metrics: Track the performance of different channels (e.g., SEO, email, paid ads) and determine which one gives you the most customers for the least cost.

- Channel Optimization: Once you identify high-performing channels, allocate more resources to them while optimizing or scaling back on underperforming ones. Continuous A/B testing can help identify the most effective ad creatives, landing pages, and messaging.

5. Leverage Customer Referrals

Word-of-mouth marketing is one of the most cost-effective ways to acquire new customers. Referrals tend to have a lower CAC and a higher conversion rate.

- Referral Programs: Implement referral programs that incentivize existing customers to refer new ones. For example, offer discounts, free products, or exclusive access for every successful referral.

- Customer Advocacy: Encourage your satisfied customers to leave reviews, share testimonials, and promote your brand on social media. User-generated content and social proof can reduce the need for paid acquisition.

6. Optimize Your Sales Funnel

Your sales funnel is the process through which potential customers become actual customers. A well-optimized sales funnel can significantly reduce CAC by improving conversion rates at each stage.

- Improve Lead Qualification: Ensure that your sales team is focusing on qualified leads that are more likely to convert. Use lead scoring techniques to prioritize high-potential prospects.

- Streamline Processes: The shorter the time between lead generation and conversion, the lower your CAC. Reduce friction at each stage of the funnel and ensure that all team members are aligned on your ideal customer profile and messaging.

Strategies to Reduce CAC

Reducing CAC requires a combination of optimizing existing processes, improving customer targeting, and exploring cost-effective marketing strategies.

1. Improve Targeting and Segmentation

Targeting the right audience is key to reducing CAC. With better segmentation, you can tailor your messages and campaigns to specific customer groups, increasing the likelihood of conversion.

- Use Data-Driven Insights: Analyze your customer data to define your ideal customer profile (ICP). Use this data to refine your targeting efforts across all channels.

- Narrow Your Focus: Instead of targeting a broad audience, narrow your focus to specific segments that are more likely to convert. This could mean targeting a specific geographic location, industry, or demographic group.

2. Leverage Marketing Automation

Automation tools can streamline your marketing efforts, improve lead nurturing, and ultimately reduce CAC by saving time and resources.

- Automated Lead Nurturing: Set up automated email campaigns and workflows to nurture leads through the funnel, saving your team valuable time.

- Sales Automation: Automate sales tasks such as follow-up emails, lead scoring, and reminders to improve team efficiency and reduce manual effort.

3. Focus on Conversion Rate Optimization (CRO)

Improving the conversion rate on your website and landing pages can have a direct impact on reducing CAC.

A well-optimized website that effectively guides visitors toward a purchase can lower the cost of acquiring a customer.

- A/B Testing: Conduct regular A/B tests on your landing pages, CTAs, forms, and ad creatives to determine which versions perform best.

- Improve User Experience (UX): Ensure your website is user-friendly, with intuitive navigation and fast load times to reduce bounce rates and increase conversions.

4. Build Strong Brand Awareness

Investing in your brand is a long-term strategy that can help reduce CAC by generating organic traffic and reducing reliance on paid advertising.

- Content Marketing: Create high-quality content that educates, informs, and entertains your audience. Over time, valuable content will attract customers organically, reducing your dependence on paid channels.

- Social Proof: Showcase customer reviews, testimonials, and case studies to build trust and credibility. People are more likely to purchase from a brand they trust.

Final Thoughts

Reducing Customer Acquisition Cost (CAC) is a key step toward achieving sustainable growth and profitability.

By understanding how CAC is calculated, how to use it strategically, and implementing the right tactics to reduce it, you can optimize your customer acquisition efforts and enhance overall business performance.

Whether through better targeting, optimizing your sales funnel, leveraging marketing automation, or focusing on retention strategies, there are countless ways to improve your CAC.

By consistently tracking and refining your acquisition strategies, you can drive more efficient growth, attract high-value customers, and ultimately, increase profitability.

CAC is not just a metric—it’s a tool for strategic decision-making. When you use it wisely, it can help propel your business to new heights and ensure that you’re acquiring customers in the most cost-effective way possible.